Regrettably, the share price of Esports Entertainment Group, Inc. (NASDAQ:GMBL) has plummeted 36% in the past month, extending the recent period of loss. This caps off a challenging year for long-term shareholders with a 100% decline in the share price.

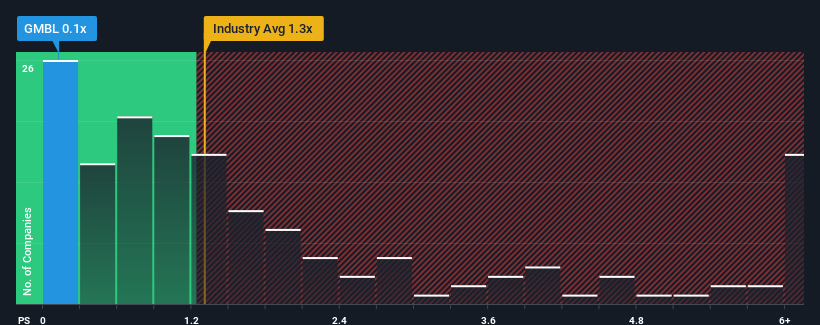

Bearing in mind the substantial drop in price, and given that about half of the companies in the US’s Hospitality industry possess price-to-sales ratios (or “P/S”) above 1.3x, Esports Entertainment Group, with its 0.1x P/S ratio, may seem an appealing investment option. However, it is crucial to delve deeper to ascertain if there is a rational explanation for this lower P/S ratio.

See our most recent analysis of Esports Entertainment Group

The Performance of Esports Entertainment Group So Far

In the past year, revenue at Esports Entertainment Group has been on the decline, which isn’t an encouraging sign. It could be that many anticipate the lackluster performance on the revenue front to persist or even intensify, thereby suppressing the P/S. If you’re keen on the company, you are likely hoping it’s not the case, offering a chance to obtain some stocks while they are undervalued.

For a clearer idea of the company’s future, check out our free report on Esports Entertainment Group’s earnings, revenue and cash flow, since we lack analyst forecasts.

What Does Esports Entertainment Group’s Revenue Growth Look Like?

It’s often assumed that a company should lag behind the industry for P/S ratios like Esports Entertainment Group’s to be considered fair.

Over the past year, the company has unfortunately seen its top-line shrink by a significant 69%. However, over a three-year period, revenues have skyrocketed, despite a few setbacks in the last 12 months. Consequently, despite the recent decline, the increase in company revenue has been impressive, but investors might wonder why it’s now falling.

Compared to the industry’s 15% one-year growth forecast, the recent medium-term revenue trajectory appears even more enticing.

Seeing Esports Entertainment Group’s P/S ratio fall below the majority of other companies is somewhat intriguing considering the equity’s recent performance. It seems some shareholders believe that the firm has reached its growth limit and are settling for substantially lower selling prices.

Significant Takeaway

Esports Entertainment Group’s P/S ratio has declined in line with its share price. Although it would be unwise to rely on the price-to-sales ratio alone to determine if you should divest your shares, it can serve as a practical guide to the company’s future outlook.

Upon reviewing Esports Entertainment Group, we found that the company’s three-year revenue patterns are not significantly lifting its P/S ratio, despite outpacing current industry expectations. With robust revenue growth outperforming the industry, we assume that there are noticeable inherent risks to the company’s future performance, putting downward pressure on the P/S ratio. There appears to be minimal price risk if recent medium-term revenue trends persist, but investors seem to anticipate considerable revenue volatility going forward.

Remember, there may be additional risks. For example, we’ve flagged 5 warning signs for Esports Entertainment Group that warrant attention.

If you’re interested in companies with a solid track record of past earnings growth, you might want to view this free list of other companies with robust earnings growth and low P/E ratios.

Valuation can be complex, but we’re working to simplify it.

Learn whether Esports Entertainment Group is potentially overvalued or undervalued by examining our comprehensive analysis, which includes estimates of fair value, risks and warnings, dividends, insider transactions, and financial health.

Check out the Free Analysis

Do you have any comments on this article? Are you worried about the content? Contact us directly. Alternatively, email the editorial team at editorial-team (at) simplywallst.com.

This article, authored by Simply Wall St, is general. We provide commentary based solely on historical data and analyst predictions following an unbiased methodology. This is not tantamount to financial advice. It should not be construed as a buying or selling suggestion for any stock and does not take into consideration individual financial positions or objectives. We strive to bring you long-term, data-driven analyses. Bear in mind our analyses might not factor in recent company-specific developments or qualitative information. Simply Wall St holds no stocks mentioned in this article.