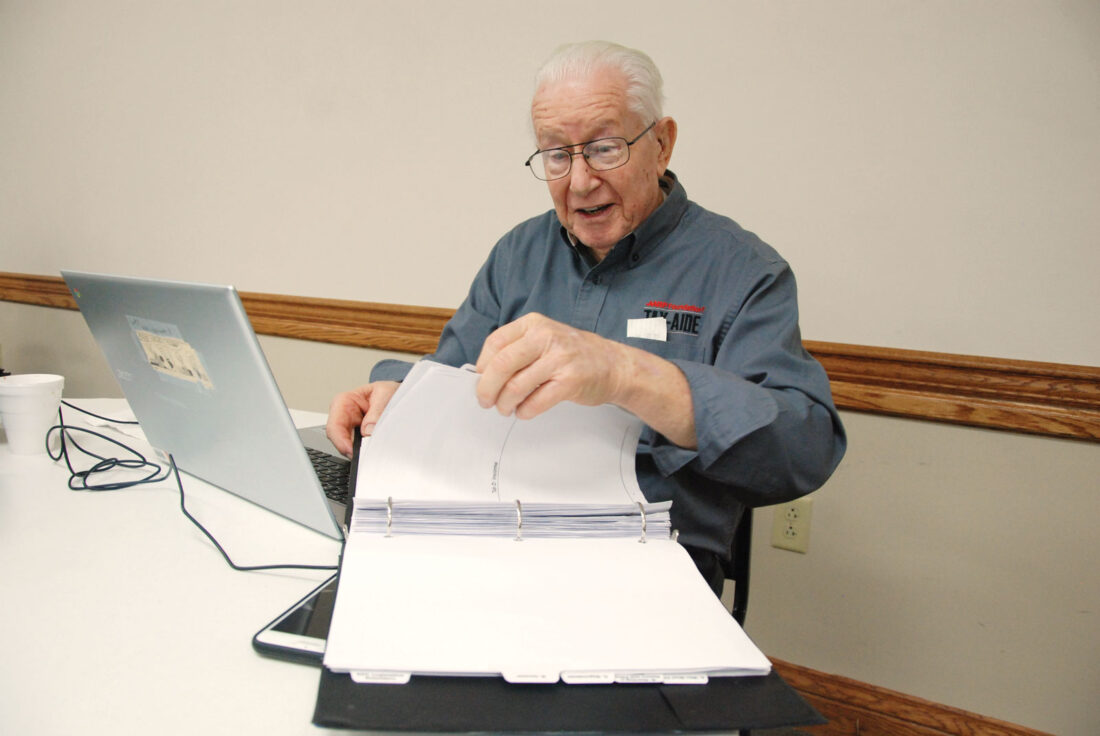

AARP Tax-Aide volunteer Robert Bumgarner looks through documents he uses to assist people with their tax returns during one of the last sessions this season at the Knights of Columbus hall in Harmar. Bumgarner has been working with the program for 29 years. (Photo by Evan Bevins)

Today’s the deadline for filing income tax returns, but some folks who already wrapped theirs up were helped across the finish line by longtime AARP Tax-Aide volunteer Robert Bumgarner.

Bumgarner, who gave his age as 90-plus, retired as a science teacher from Marietta City Schools nearly 30 years ago. He’d been doing his own taxes for a while when he heard about the AARP program, which offers free preparation of simpler returns for individuals.

“One of the people that worked in it knew I was retiring, talked to me about it and asked if I was interested,” Bumgarner said.

Twenty-nine years later, he’s still interested.

“I like the people we’re working with,” Bumgarner said last week, on the final day of the free service at the Knights of Columbus building in Harmar. “And the people that you’re doing taxes for appreciate it too.”

A lot has changed over the years, Bumgarner said, starting with the way the volunteers do their work.

“When I started, we did them with pencil and paper,” he said. Now, “the computer does all of the math.

“Back when you were doing them by pencil and paper, you would remember a lot more stuff,” he added. But “you can make changes a lot faster.”

AARP furnishes the computers the volunteers use and provides training each year to make sure they’re up to date on the latest changes. No one volunteer may know everything, but that’s where collaboration comes in.

“What I don’t know, Linda does,” Bumgarner said, gesturing to Linda Lawton, administrative specialist and counselor for AARP Tax-Aide, at the next table over. “If something doesn’t click very quickly, we can look it up.”

One volunteer prepares the return, then another reviews it. That’s been Bumgarner’s role the last few years.

Lawton said she and the other volunteers appreciate Bumgarner’s continued service.

“We love Bob,” she said. “He knows his stuff, and he asks great questions.”

Like so many things, the COVID-19 pandemic changed the tax assistance program too.

“We used to, it was just walk-ins,” Bumgarner said. “And now it’s appointments through the library.”

Exemptions and qualifications for exemptions have increased over the years, Bumgarner said.

“Most of the people we get take the standard deduction,” he said. “And that makes it a lot easier than having to itemize everything.”

Lawton said the program is always looking for additional volunteers, “somebody who’s friendly and likes to be around people.” Prospective volunteers should be comfortable working with a computer and available from February to April.

“We train people. We supply the computers,” Lawton said.

Bumgarner recommended checking it out.

“I think they should try it,” he said.

Bumgarner is married to longtime area schools superintendent Dora Jean Bumgarner. They have two adult sons and two grandchildren.